Introduction to Stock Market Cycles

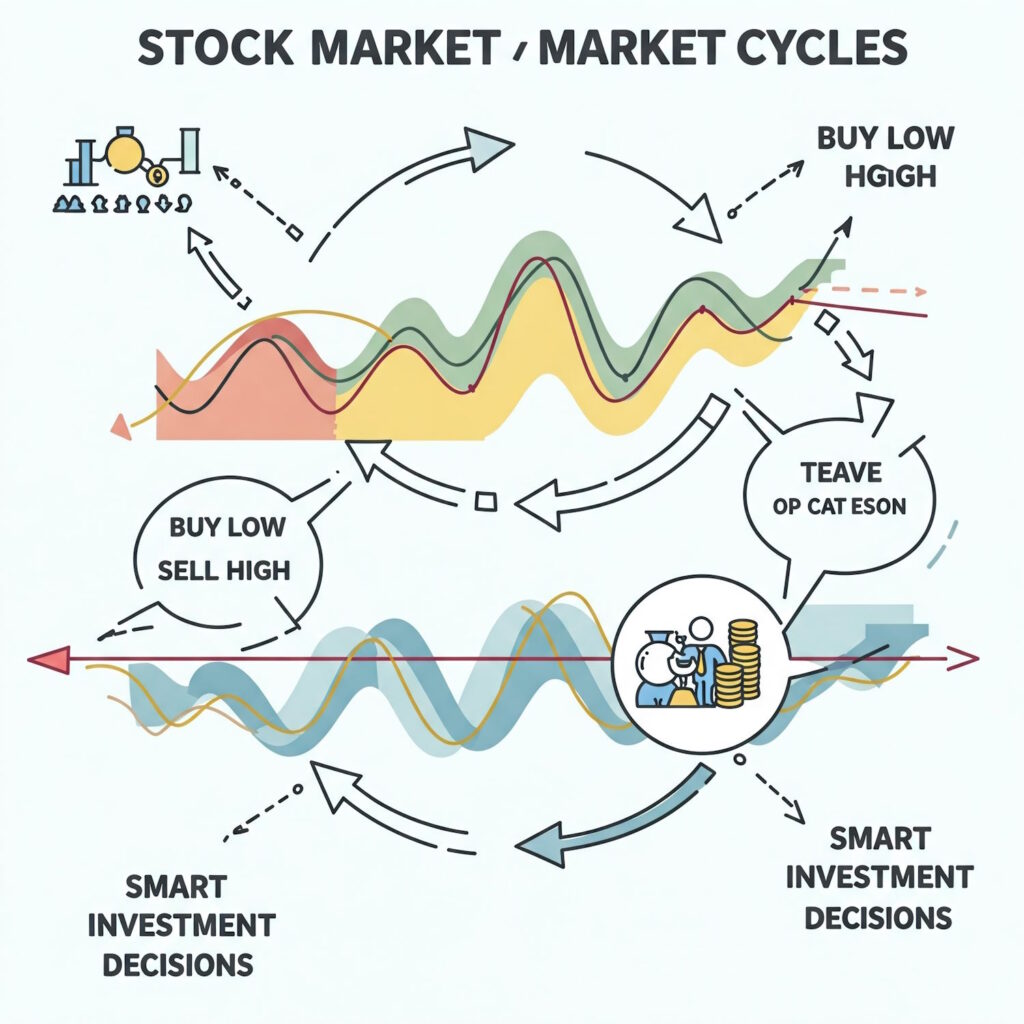

Stock market cycles are integral components of the financial landscape, representing the recurring patterns of price movements in the equity markets. Understanding these cycles is crucial for investors, as they provide insights into market behavior and facilitate strategic investment decisions. Each cycle is typically divided into four distinct phases: expansion, peak, contraction, and trough. Recognizing these phases can significantly enhance an investor’s ability to navigate the complexities of the stock market.

The expansion phase marks a period of economic growth where stock prices generally rise, driven by increasing corporate profits, low-interest rates, and investor optimism. This phase often leads to the peak, characterized by heightened market enthusiasm and stock prices reaching their zenith. However, peak conditions tend to stabilize and are frequently followed by a contraction phase, wherein economic activity slows down, resulting in declining stock prices. During this time, companies may face lowered earnings, which can lead to increased selling pressure among investors.

The final stage of the cycle is known as the trough, where stock prices hit their lowest points. This phase is typically associated with bearish market sentiment and economic challenges. However, it also presents unique opportunities for investors who can identify undervalued stocks during this period. Understanding stock market cycles allows investors to devise strategies that align with market movements, fostering more informed decision-making regarding when to buy and sell equities.

In summary, stock market cycles are essential for grasping the dynamics of price fluctuations and capitalizing on market opportunities. By recognizing the characteristics and shifts within these cycles, investors can better position themselves for long-term success in the stock market.

Phases of Stock Market Cycles

The stock market operates in cycles, which can be categorized into four distinct phases: expansion, peak, contraction, and trough. Each phase is characterized by unique market indicators and investor behaviors, influencing trading strategies and investment decisions.

The expansion phase marks a period of rising stock prices, typically fueled by increasing economic activity and investor confidence. During this phase, indicators such as rising GDP, decreasing unemployment, and higher corporate earnings often emerge. Historical examples highlight the post-2008 financial crisis recovery, where markets saw sustained growth due to monetary stimulus and favorable economic conditions. Investors during the expansion phase may focus on growth stocks and investment opportunities, capitalizing on their upward momentum.

As the expansion phase progresses, the market reaches its peak. This phase is characterized by stock prices hitting their highest points, followed by signs of overvaluation. Indicators may include high P/E ratios and a surge in speculative investments. A classic historical instance is the dot-com bubble in the late 1990s, where excessive optimism led to inflated stock valuations before a significant downturn. Investors must exercise caution during this phase, as signs of a market correction may begin to surface.

The contraction phase is characterized by declining stock prices and increased volatility. Economic indicators show slowing GDP growth, rising unemployment, and decreased consumer spending. Following the peak phase, the contraction phase can lead to a bear market, where investor sentiment turns negative. The 2008 financial crisis serves as a reminder of how swiftly markets can retract, impacting portfolios. During this phase, investors may explore defensive stocks or alternative investment strategies to mitigate losses.

Finally, the trough phase represents the lowest point of the market cycle before recovery begins. During this period, stock prices are at their lowest, often accompanied by pessimism and uncertainty. However, significant buying opportunities may emerge for those who recognize the potential for future growth. Historical trends indicate that many successful investment strategies capitalize on this phase, positioning themselves for the subsequent expansion. By understanding these phases, investors can make informed decisions and better anticipate market movements.

Historical Context of Market Cycles

The stock market has undergone numerous cycles over its extensive history, each characterized by fluctuating trends that reflect the broader economic environment. Understanding historical stock market cycles can provide valuable insights into investor behavior and predictive patterns that can be leveraged for future profits. Economic theorists and financial analysts have identified various phases within these cycles: expansion, peak, contraction, and trough. Each phase is defined by pivotal historical events that shape investor sentiment and market performance.

One of the most notable periods of market expansion occurred during the post-World War II era, often referred to as the “Golden Age of Capitalism,” when economic growth was robust, and corporate profits soared. This era culminated in peak conditions that eventually paved the way for the recession of the 1970s. It exemplified how external influences, such as geopolitical stability and technological advancements, contribute significantly to market cycles. The lessons derived from this period emphasize that investors often exhibit overconfidence during expansion, leading to increased risk-taking that is frequently followed by significant corrections.

Moreover, another critical phase is exemplified by the dot-com bubble of the late 1990s. It serves as a cautionary tale about the psychology of speculative investing, where exuberance led to inflated stock valuations. The subsequent downturn in the early 2000s highlighted an essential pattern within market cycles: when investor confidence wanes, sell-offs can occur rapidly, exacerbated by fear and uncertainty. Analyzing such events allows investors to recognize emotional triggers that govern market movements, facilitating more informed decision-making in current conditions.

To effectively utilize historical data in the context of market cycles, it is crucial to maintain a disciplined approach. Patterns observed in previous cycles provide a framework for evaluating present-day market conditions, reinforcing the notion that while markets are influenced by various factors, the underlying behavioral tendencies of investors remain remarkably consistent.

Technical Analysis: Tools for Identifying Cycles

In order to navigate the fluctuating nature of the stock market, investors can leverage various technical analysis tools that assist in identifying market cycles. By employing such tools, individuals can enhance their ability to determine optimal entry and exit points aligned with market trends. Among the most prevalent tools are moving averages, trend lines, and chart patterns, each serving a unique role in recognizing cycles.

Moving averages represent a fundamental component in technical analysis. They are used to smooth out price data over a specific period, thereby filtering out market noise and revealing the underlying trend. Investors commonly utilize two types: the simple moving average (SMA) and the exponential moving average (EMA). The SMA calculates the average price over a chosen number of days, while the EMA gives greater weight to more recent prices. By observing crossover points between different-moving averages, investors can identify potential shifts in market cycles, often signaling a change in trend.

Trend lines serve as another valuable tool in recognizing cycles. They are straight lines drawn on a chart that connect the lows or highs of the price action, providing visual insights into the prevailing direction of the market. An upward trend line indicates higher highs and higher lows, demonstrating bullish sentiment, while a downward trend line indicates bearish sentiment. Breaks in these lines can suggest the commencement or conclusion of a cycle, allowing investors to make informed decisions based on these price movements.

In addition to moving averages and trend lines, chart patterns, such as head and shoulders or double tops and bottoms, play a crucial role in identifying stock market cycles. These patterns often predict reversals or continuation of trends, offering further signals to traders. By applying these technical analysis tools, investors can adeptly navigate stock market cycles and position themselves strategically within the marketplace.

Economic Indicators Affecting Cycles

Understanding stock market cycles is pivotal for investors who aim to navigate the complexities of financial markets. Various economic indicators play a significant role in influencing these cycles, impacting investor sentiment and overall market performance. The three primary indicators include interest rates, inflation, and unemployment rates.

Interest rates are a critical economic factor that directly affects stock market dynamics. When central banks, such as the Federal Reserve in the United States, alter interest rates, it can lead to increased borrowing costs or reduced borrowing capacity for businesses. Lower interest rates typically stimulate spending, which can lead to higher corporate profits. Conversely, higher rates often result in decreased investment and consumer spending, potentially initiating a downturn in the market. Investors closely monitor interest rate trends to anticipate changes in market conditions and adjust their portfolios accordingly.

Inflation, another crucial indicator, reflects the rising cost of goods and services. Moderate inflation is generally favorable for stocks, as it may signify a growing economy. However, high inflation can erode purchasing power and lead to tighter monetary policies, which may negatively impact stock prices. Understanding the relationship between inflation and stock performance assists investors in recognizing the potential risks and rewards associated with their investments.

Lastly, unemployment rates serve as an essential barometer of economic health. High unemployment indicates a lack of consumer spending, which can hinder business growth and profitability, ultimately leading to bearish market conditions. On the other hand, low unemployment typically signifies a robust economy, often resulting in bullish market trends. Investors should pay close attention to employment data to gauge economic strength and make informed investment decisions.

In conclusion, by analyzing these key economic indicators—interest rates, inflation, and unemployment rates—investors can gain valuable insights into stock market cycles. This understanding allows them to make more informed decisions, enhancing their ability to respond to changing market conditions. Considering macroeconomic data is essential for navigating the complexities of stock market investing effectively.

Strategies to Profit from Stock Market Cycles

Profiting from stock market cycles requires a combination of timely decision-making and a strategic approach. One popular strategy is the practice of buying low during economic contractions. This approach capitalizes on the fact that markets often overreact to negative news, leading to undervalued stocks. Investors can identify stocks that demonstrate strong fundamentals but are priced lower due to overall market sentiment. By purchasing these stocks at a discount, an investor positions themselves to benefit when the market eventually recovers and these stocks appreciate in value.

Conversely, selling high during periods of expansion is equally important. In bullish markets, stock prices can exceed their intrinsic values, prompting a strategy that involves selling overvalued holdings. This technique helps lock in profits before market corrections occur. Investors can monitor market indicators and conduct regular evaluations of their portfolios to ensure they are prepared to act at the right moment.

Another effective investment strategy is dollar-cost averaging, which involves consistently investing a fixed amount of money into a particular asset at regular intervals, regardless of its price. This method reduces the impact of volatility by averaging out the purchase cost over time, allowing investors to accumulate more shares when prices are low and fewer when prices rise. This disciplined approach helps to mitigate the risks associated with attempting to time the market.

Tactical asset allocation is also a useful strategy that entails adjusting one’s portfolio mix based on the current phase of the market cycle. This involves reallocating assets to maintain a favorable balance between risk and return as market conditions change. For instance, during an economic downturn, an investor might shift towards more defensive sectors such as utilities or consumer staples, while reallocating back to growth sectors during an expansion.

Real-life case studies demonstrating these strategies illustrate their effectiveness. For example, investors who practiced dollar-cost averaging in the wake of the 2008 financial crisis subsequently reaped substantial rewards as the market recovered over time. By applying these strategies thoughtfully, investors can navigate stock market cycles and enhance their chances of long-term success.

Risk Management During Cycles

Investing in the stock market involves navigating various cycles, each characterized by distinct trends and investor sentiments. Understanding these cycles is crucial, but equally important is implementing effective risk management strategies to safeguard investments, especially during times of volatility. One of the primary methods for mitigating risk is diversification. By spreading investments across a variety of asset classes, sectors, or geographical regions, investors can reduce their exposure to any single market downturn. This strategy ensures that a decline in one portion of the portfolio does not lead to significant losses overall.

Additionally, employing stop-loss orders serves as another critical tool in managing risk. A stop-loss order allows investors to set a predetermined price point at which shares will automatically be sold, thereby limiting potential losses should the market move unfavorably. It acts as a protective cushion, preventing emotional decision-making during drastic fluctuations. This method is particularly beneficial during market cycles marked by rapid declines, as it helps to lock in gains or minimize losses without necessitating constant monitoring of market movements.

Furthermore, investors may consider implementing position sizing as a form of risk management. By controlling the number of shares or the dollar amount invested in a specific stock, one can effectively manage the overall exposure to any single investment. This strategy emphasizes the importance of conditional risk assessments before making any trades, allowing investors to enter positions that align with their risk tolerance.

Overall, comprehensive risk management strategies are indispensable for investors navigating stock market cycles. By prioritizing diversification, utilizing stop-loss orders, and maintaining prudent position sizes, investors can better protect themselves from the inherent volatility of the market, ensuring their financial resilience during both bullish and bearish phases.

Psychological Aspects of Market Cycles

Understanding the psychological factors that impact stock market cycles is essential for investors seeking to navigate these turbulent waters effectively. Market movements are not solely driven by economic indicators and financial data; they are significantly influenced by the emotions and behaviors of investors. Specifically, fear and greed are two dominant emotions that can cloud judgment and lead to irrational decision-making.

During bull markets, the prevailing sentiment is often one of greed, where investors become overly optimistic, driven by the desire to capitalize on rising prices. This exuberance can lead to the formation of asset bubbles, as investors ignore underlying valuations, focusing instead on potential profits. Conversely, during bear markets, fear takes center stage. Investors panic as asset prices decline, prompting them to sell at potentially unfavorable prices to avoid further losses. This fear-driven activity disrupts logical investment strategies, causing many to miss out on opportunities for long-term gains.

The herd mentality further complicates the psychological landscape of market cycles. When a significant number of investors succumb to fear or greed, they tend to follow the crowd, often abandoning their personalized investment strategies. This collective behavior can lead to exaggerated market movements, resulting in volatility that may not reflect the fundamentals of the underlying assets. Recognizing these patterns is crucial for investors aiming to maintain discipline and adhere to a well-structured investment plan.

By understanding and acknowledging the psychological aspects influencing market cycles, investors can better prepare themselves to face the emotional challenges of investing. Educating oneself about cognitive biases and employing strategies such as diversification can mitigate the risks associated with these psychological factors. Ultimately, an awareness of the emotional landscape of the stock market will enable investors to make rational decisions and enhance their chances of profitability over time.

Conclusion: Navigating the Cycles for Long-Term Success

Understanding stock market cycles is essential for achieving sustained investment success. Throughout this blog post, we have explored the cyclical nature of the stock market, identifying key phases such as expansion, peak, contraction, and trough. Each phase presents unique opportunities and challenges that investors must recognize to navigate market fluctuations effectively. An informed investor can position themselves advantageously by acknowledging these cycles and adapting their strategies accordingly.

One significant takeaway is that timing the market is inherently difficult, if not impossible. Instead, investors should focus on the fundamentals of their investments while monitoring market conditions. By employing a long-term perspective, individuals can better ride out the inevitable ups and downs of the stock market. This perspective encourages individuals to remain patient and not be swayed by short-term volatility, which is often influenced by emotions rather than sound investment principles.

Moreover, as the landscapes of economies and market dynamics continuously evolve, investors must commit to lifelong learning. Staying informed about economic trends, geopolitical events, and regulatory changes will enhance one’s ability to make strategic decisions throughout various market cycles. Engaging with educational resources and maintaining a critical perspective will empower investors to adapt their approaches as necessary.

Ultimately, understanding stock market cycles equips investors with the tools to make more informed decisions and potentially enhance their returns. As we have discussed, the key to long-term success lies in recognizing market patterns and being prepared for all phases of the cycle. By applying these insights in their investment strategies, individuals can navigate the complexities of the stock market with greater confidence and resilience.